Common Challenge

Background, current situation, expected demand

It is expected that 90% of the currently existing building stock will still be in service in 2050, the year in which many cities want to reach carbon neutrality. European policies and legislation are in place to accelerate the decarbonisation in the building sector, starting out, however, from a situation where renovation is making only a moderate contribution (0.4 to 1.2% of buildings per year) and the complete replacement of the existing stock is very slow (1-1.5% per year) and not desirable. To achieve our climate goals, renovation in Europe must be accelerated, lifting many more existing buildings to an optimal efficiency level as well as maximising the self-use of renewable energy.

An increasing number of cities, regions and other owners of major building portfolios wish to achieve 100% renewable energy supply (RES) in their buildings. These actors are faced with barriers, such as individual constraints for adaptation for each building, provision of supply and storage, optimisation of operation and integration of solutions across technologies. Integration of the optimal selection of cutting-edge Renewable Energy technologies requires a level of expertise most owners and their planners cannot be expected to acquire. The construction sector is extremely fragmented, where more than 95% of manufacturers and professionals operate as Small and Medium-Sized Enterprises (SMEs), and most in separate national or local markets. Furthermore, investors have a natural preference for low-risk solutions and a scepticism to complexity.

Currently, there are no adequate products on the market which can deliver a 100% renewable building without undertaking invasive measures to the envelope. The Buyers Group alone operates 21,000 buildings; almost a dozen other procurers are already following the project with more expected. Their portfolios constitute ten-thousands of buildings with sufficient envelope quality to deploy the envisioned solutions. Procurers wish these buildings to be supplied by 100% local RES within a short timeframe. To make this possible, it is expected that suppliers will follow an “active approach”, optimising heavy loads in heating, ventilation, and air conditioning (HVAC) etc, adding intelligent (remote) control, energy production and storage while responding to specific usage requirements to optimise the entire building.

The common challenge

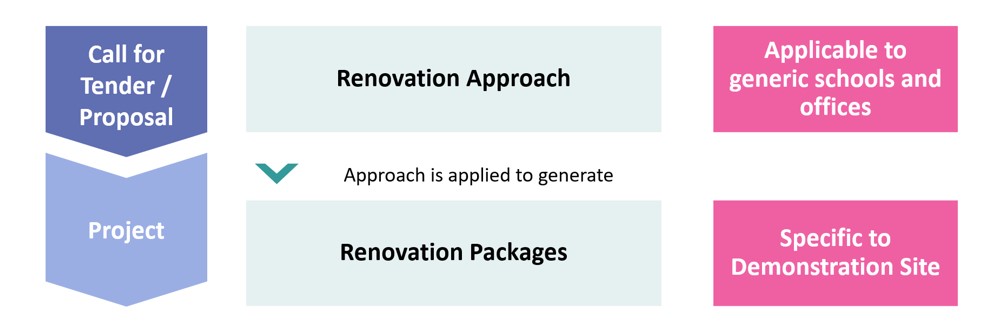

Suppliers are to design, develop, and test an innovative Renovation Approach capable of generating Renovation Packages delivering 100% renewable energy supply to any existing non-residential building with adequate envelope quality. The Renovation Approach is to be tested through generating and implementing Renovation Packages for specific non-residential buildings in Buyers Group portfolios, the Demonstration Sites.

A supplier’s Renovation Approach is expected to constitute a complete set of methods, technologies, services and devices integrated in a well-documented toolkit which includes at least: building assessment framework, system design and control approach, RES production, interoperable integration of legacy devices, data management and data sharing, building control, storage solutions, finance and contracting models, life-cycle cost approach, continuous commissioning, behaviour-targeting education and training of occupants and professionals.

During Phase I and Phase II, suppliers adapt, extend, and apply their Renovation Approach to generate Renovation Packages for six specific buildings in Buyers Group portfolios with increasing level of detail. During these two phases, suppliers will apply their Co-Design procedure to facilitate information exchange, involvement, decision-making etc. Successful tenderers for Phase III will then implement the Renovation Packages in three allocated buildings, ensure performance and apply the Continuous Commissioning procedure. The initial delivery of the Renovation Package is to be turnkey-ready.